Table of Contents

Global Commodity Markets

Global Commodity Markets have evolved in the last 150 years with the emergence of the organized financial marketplace. The need to mitigate risk due to the volatility in asset prices led to innovation of sophisticated financial instrument. Improved satellite technology with superior digital communication and faster processing speed facilitated emergence of electronic trading platforms that are accessible with secure connectivity even from distant locations.

Active trading in commodity markets enables discovery of the fair price of an asset. Initially, when trading was possible only in over-the-counter markets, it exposed genuine hedgers to default risk. If a trader wanted to offset an existing open position, it was difficult to liquidate the same due to the customized nature of the contract. There was no mechanism to ensure guarantee of settlement, after the trade was made.

This eventually gave rise to organized marketplaces – namely, commodity exchanges. These exchanges provided the platform to trade in financial instruments and ensured guarantee of settlement. Further, the standardization of the traded contracts led to increased liquidity. The following sections discuss the evolution of the global commodity markets and distinguish between the specific instruments available for hedging against commodity price risk.

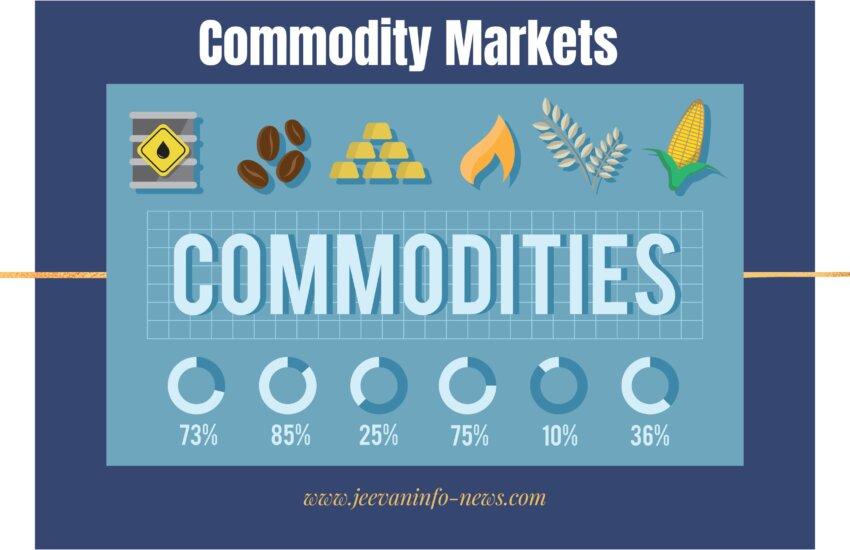

A Market Where Commodities Are Traded Is Referred To As A Commodity Market. These commodities include bullion [Gold, Silver, Platinum, Palladium], ferrous [Steel] and non-ferrous metals [Copper, Zinc, Nickel, Lead, Aluminum, Tin], energy products [Crude Oil, Natural Gas, Heating Oil, Gasoline, etc.], agricultural commodities [Refined Soya Oil, Pepper, Palm Oil, Coffee, Pepper, Cashew, Almonds, etc.].

Existence of a vibrant, active, and liquid commodity market is normally considered as a healthy sign of development of a country’s economy. Growth of a transparent commodity market is a sign of development of an economy. It is therefore important to have active commodity markets functioning in a country.

Markets have existed for centuries worldwide for selling and buying of goods and services. The concept of market started with agricultural products and hence it is as old as the agricultural products or the business of farming itself. Traditionally, farmers used to bring their products to a central marketplace in a town/village where grain merchants/traders would also come and buy the products and transport, distribute and sell them to other markets.

In a traditional market, agricultural products would be brought and kept in the market and the potential buyers would come and see the quality of the products and negotiate with the farmers directly on the price that they would be willing to pay and the quantity that they would like to buy. Deals were struck once mutual agreement was reached on the price and the quantity to be bought/sold.

Shortage of a commodity in a given season would lead to increase in price for the commodity. On the other hand, oversupply of a commodity on even a single day could result in decline in price – sometimes below the cost of production. Neither farmers nor merchants were happy with this situation since they could not predict what the prices would be on a given day or in a given season. As a result, farmers often returned from the market with their products since they failed to fetch their expected price and since there were no storage facilities available close to the marketplace. It was in this context that farmers and food grain merchants in Chicago started negotiating for future supplies of grains in exchange of cash at a mutually agreeable price. This type of agreement was acceptable to both parties since the farmer would know how much he would be paid for his products, and the dealer would know his cost of procurement in advance. This effectively started system of commodity forward contracts, which subsequently led to futures market too.

It is interesting and also necessary to know more about the historical evolution of commodity markets, global commodity exchanges and their operations.

It is widely believed that the futures trade first started about approximately 6,000 years ago in China with rice as the commodity. Futures trade first started in Japan in the 17th century. Forward markets were also reportedly started in Antwerp around the same time. In ancient Greece, Aristotle described the use of call options by Thales of Miletus on the capacity of olive oil presses. The first organized futures market was the Osaka Rice Exchange, in 1730.

Development Of Commodity Exchanges

Historically, organized trading in futures began in the USA in the mid-19th century with maize contracts at the Chicago Board of Trade [CBOT] and a bit later, cotton contracts in New York. In the first few years of CBOT, weeks could go by without any transaction taking place and even the provision of a daily free lunch did not entice exchange members to actually come to the exchange! Trade only took off in 1856, when new management decided that the mere provision of a trading floor was not sufficient and invested in the establishment of grades and standards as well as a nation-wide price information system. CBOT preceded futures exchanges in Europe.

In the 1840s, Chicago had become a commercial center since it had good railroad and telegraph lines connecting it with the East. Around this same time, good agriculture technologies were developed in the area, which led to higher wheat production. Midwest farmers therefore used to come to Chicago to sell their wheat to dealers who, in turn, transported it all over the country.

Farmers usually brought their wheat to Chicago hoping to sell it at a good price. The city had very limited storage facilities and hence, the farmers were often left at the mercy of the dealers. The situation changed for the better in 1848 when a central marketplace was opened where farmers and dealers could meet to deal in “Cash” grain-that is, to exchange cash for immediate delivery of wheat.

Farmers [Sellers] and dealers [Buyers] slowly started entering into contract for forward exchanges of grain for cash at some particular future date so that farmers could avoid taking the trouble of transporting and storing wheat [at very high costs] if the price was not acceptable. This system was suitable to farmers as well as dealers. The farmer knew how much he would be paid for his wheat and the dealer knew his costs of procurement well in advance.

Such forward contracts became common and were even used subsequently as collateral for bank loans. The contracts slowly got “Standardized” on quantity and quality of commodities being traded. They also began to change hands before the delivery date. If the dealer decided he didn’t want the wheat, he would sell the contract to someone who needed it. Also, if the farmer didn’t want to deliver his wheat, he could pass on his contractual obligation to another farmer. The price of the contract would go up and down depending on what was happening in the wheat market. If the weather was bad, supply of wheat would be less and the people who had contracted to sell wheat would hold on to more valuable contracts expecting to fetch better price; if the harvest was bigger than expected, the seller’s contract would become less valuable since the supply of wheat would be more.

Slowly, even those individuals who had no intention of ever buying or selling wheat began trading in these contracts expecting to make some profits based on their knowledge of the situation in the market for wheat. They were called speculators. They hoped to buy [long position] contracts at low price and sell them at high price or sell [short position] the contracts in advance for high price and buy later at a low price. This is how the futures market in commodities developed in the U.S. The hedgers began to efficiently transfer their market risk of holding physical commodity to these speculators by trading in futures exchanges.

The history of commodity market in the United States of America [USA] has the following landmarks:

-

- Chicago Board of Trade [CBOT] was established in Chicago in 1848 to bring farmers and merchants together. It started active trading in futures-type of contracts in 1865.

- The New York Cotton Exchange was started in 1870.

- Chicago Mercantile Exchange was set up in 1919.

- Legalized options’ trading was started in 1934.

MCX, India’s No. 1 Commodity Exchange

Multi Commodity Exchange of India Ltd. [MCX] is a “new order” exchange with permanent recognition from the Government of India. MCX is a nationwide, online [electronic] multi-commodity marketplace that offers “Unparalleled Efficiencies“, “Unlimited Growth“, and “Infinite Opportunities” to market participants. MCX is a demutualized exchange since inception. Promoted by Financial Technologies (India) Limited, MCX has introduced a state-of-the-art, online digital exchange for commodities trading in the country. MCX has emerged as the largest commodity derivatives exchange in India. It facilitates trading in bullion, energy, agricultural commodities, base metals, ferrous and other commodities including electricity and emissions trading.

Major Commodities Traded World Over

Following is the list of major commodities traded world over in global commodity exchanges:

-

- Bullion: Gold, Silver, Platinum, Palladium.

-

- Energy: Light Sweet Crude Oil, Natural Gas, Heating Oil, Brent Crude, Electricity, Propane, Coal, Gasoline, Kerosene.

-

- Metals [Ferrous And Non-Ferrous]: Copper, Aluminum, Nickel, Tin, Lead, Zinc, Metal Alloys.

-

- Agri And Livestock: Live Cattle, Feeder Cattle, Lean Hog, Pork, Milk, Butter, Egg, Poultry and other farm products, Cocoa, Coffee, Sugar, Wheat, Rice, Corn, Soybean, Soybean Meal, Soybean Oil, Rubber, Cotton Yarn, Woolen Yarn, Fine Wool, Greasy Wool, Broad Wool, Barley, Canola, Canola Meal, Feed Peas, Oats, Beer-Barley, Crude Palm Oil, Green Benn, Potato, Pig, Rape Seed, Wheat, Corn, Wine, Red Beans, Cotton Yarn, Sheel Egg, Feed Barley, Sunflower Seed, Raw Silk, Rubber, Grains And Flours, Potato, Sunflower Seed And Oil, Black Matpe, Timbers, Spices Such As Pepper, Cumin, Cardamom, Cashew Nut.

Regulation Of Commodity Markets In India

In India, the Forward Markets Commission is the regulator of commodities trading. There are 3 national level commodity exchanges, namely:

-

- Multi Commodity Exchange of India Limited [MCX], India’s largest commodity derivatives exchange.

- National Commodity and Derivatives Exchange [NCDEX].

- National Multi Commodity Exchange [NMCE].

There are also 20 regional exchanges in India, the largest of them being the National Board of Trade [NBOT], Indore. There is also another national level exchange that is to be established. This is called the Indian Commodity exchange, which is proposed to be established jointly by MMTC and Indiabulls. This is tentatively slated for commencing operations in Oct 2009.

Related Posts

Money Markets And Capital Markets

Debt Markets In India

Equity Markets In India

Foreign Exchange Market

Derivatives And Other Classification Of Markets